AIG: Shares Solid On Valuation Ahead Of Earnings, Technical Risks Weigh

JHVEPhoto/iStock Editorial via Getty Images

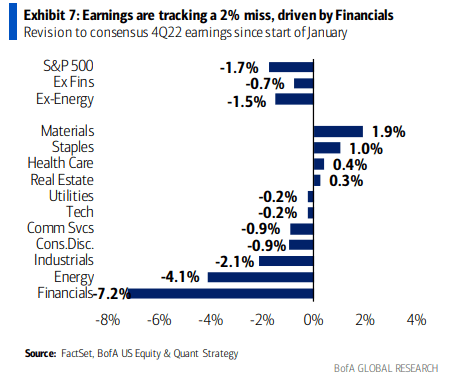

Q4 earnings are being dragged down by the financial sector. With the bulk of bank earnings in the rearview mirror, eyes will focus on other industries like insurance. The insurance space has handily beaten the S&P 500 over the last year, but can the group hold up through reporting season? That is the big question.

I see some technical risks with AIG, due to the issue with fourth-quarter earnings during the middle of February. Let’s dive deeper into this insurance giant.

Financials Earnings Falter So Far

BofA Global Research

According to Bank of America Global Research, American International Group, Inc. (NYSE:AIG) is a multi-line insurer with a global P&C footprint specializing in commercial and personal lines. The life and retirement business is U.S.-centric, with a large presence in fixed annuities and group retirement. Following a government bailout during the ’08/’09 financial crisis, AIG has struggled to reach levels of profitability delivered by peers. The recent AIG200 initiative aims to right-size AIG’s cost structure following years of business sales and the introduction of new technologies.

The $47B market cap Insurance industry company within the financial sector trades at a low 3.8 trailing 12-month GAAP price-to-earnings ratio and pays a 2.0% dividend yield, according to The Wall Street Journal. In its Q3 earnings beat, the firm reported mixed performance from its alternative investments while P&C margins were solid with less impactful catastrophe losses.

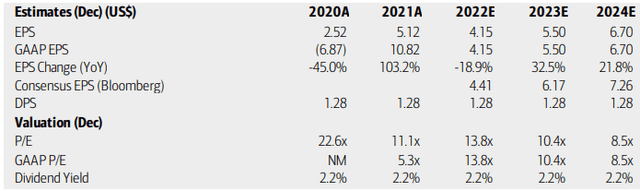

On valuation, analysts at BofA see earnings bouncing back sharply this year after dropping nearly 20% in 2022. Many P&C insurers were hit by natural disasters in the last several months, but so long as conditions are as estimated, AIG should see many upcoming quarters of improving EPS.

The Bloomberg consensus forecast is even more sanguine than what BofA projects. Dividends, meanwhile, are anticipated to hover at $1.28, so the yield is not as high as other insurance stocks. But AIG’s operating and GAAP P/Es appear attractive, perhaps falling to near 10 later this year. Overall, I continue to like the valuation.

AIG: Earnings, Valuation, Dividend Yield Forecasts

BofA Global Research

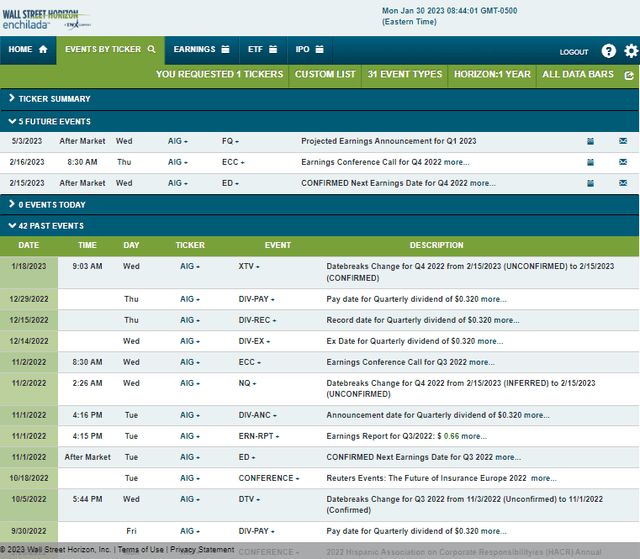

Looking ahead, corporate event data from Wall Street Horizon show a confirmed Q4 2022 earnings date of Wednesday, February 15, after the close bell with a conference call the following morning. You can listen live here. The event calendar is light on volatility catalysts aside from the reporting date.

Corporate Event Risk Calendar

Wall Street Horizon

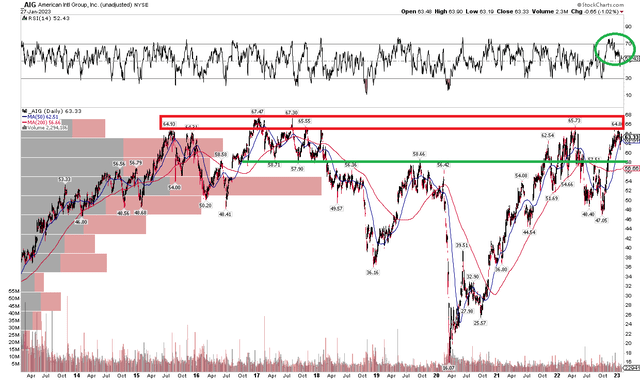

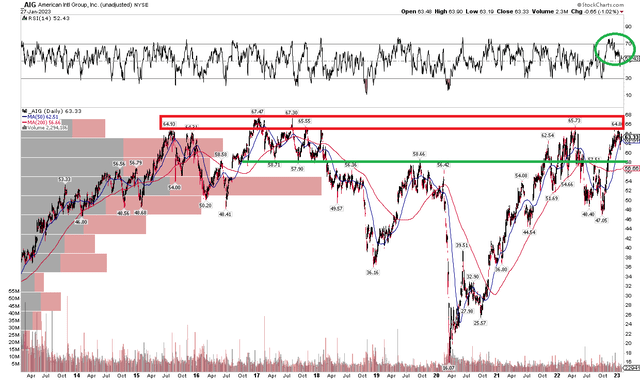

The Technical Take

Back in October, I detailed the near-term chart. This time I thought I’d zoom out to review where long-term opportunities and risks lay. Notice in the chart below that shares have indeed returned back to near their multi-year highs after a recent trendline breakout that I suggested might happen. The onus is now back on the bulls to carry the stock to new highs, but we aren’t there yet.

While I like the valuation, I am downgrading the stock to a hold based on obvious technical resistance in the $65 to $68 range. If we bust through this, perhaps after the upcoming earnings reports, then shares could have legs to around $85 based on the measured move price target that would be in play from the current $47 to $66 range.

Support is in the $57 to $59 zone. While the RSI momentum indicator has retreated from overbought levels, it remains in a bullish zone for now.

AIG: A Technical Test For The Bulls

StockCharts.com

The Bottom Line

AIG’s EPS estimates are higher now than a few months ago, and that’s ideal from a long-term valuation perspective. The chart, though, suggests investors take a wait-and-see approach. I will hopefully revisit this one later this year after the stock has broken to new multi-year highs.

Published at Mon, 30 Jan 2023 14:24:07 -0800