AbbVie: The Dreaded Humira Cliff Is Here: Time To Sell?

Ales_Utovko

The End Of An Era

When Humira was introduced back in 2003, few could have pegged it as the future best-selling prescription drug of all time. Now 20 years and more than $200 billion in sales later, AbbVie (NYSE:ABBV) faces competition from biosimilars in the US.

Amgen (AMGN) has released Amjevita, the first to come to the market, and other companies are expected to launch products during 2023.

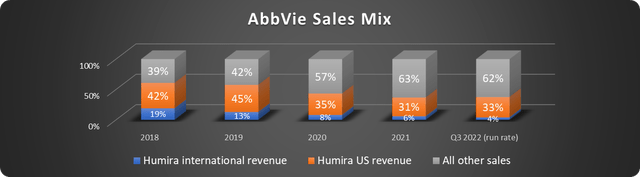

Humira sales dropped about 45% within three years (and more than 60% according to Q3 2022 figures) when biosimilars hit the international market in late 2018. It is safe to say that the US release will cost AbbVie well over $10 billion in annual sales within the next couple of years.

The silver lining is that the release of biosimilars has been anticipated for years, and management has diligently diversified AbbVie’s portfolio.

The question is: will it be enough to keep up returns for investors?

The action plan

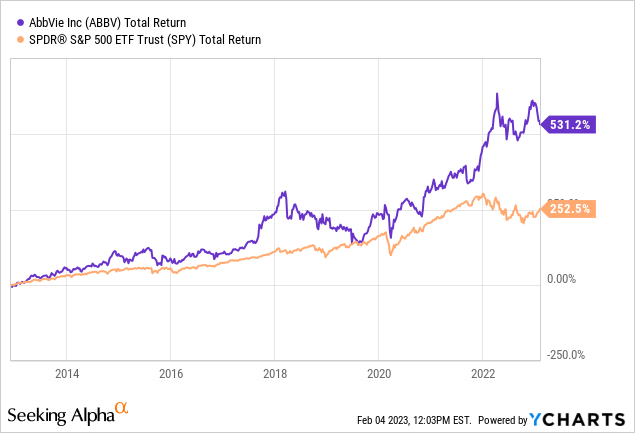

AbbVie stock has been a cash cow for investors, with a dividend often yielding over 4% and stellar total returns, as shown below.

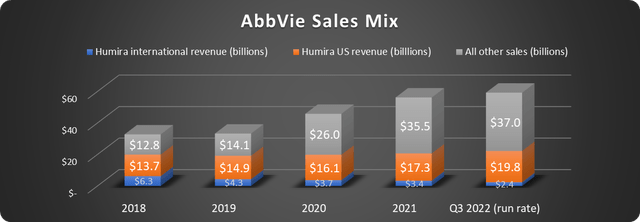

More than 60% of AbbVie’s revenue came from Humira sales as recently as 2018. Then came the blockbuster acquisition of Allergan.

Since then, sales of other drugs have nearly tripled:

Data source: AbbVie. Chart by author.

And now other sales make up over 60% of the total:

Data source: AbbVie. Chart by author.

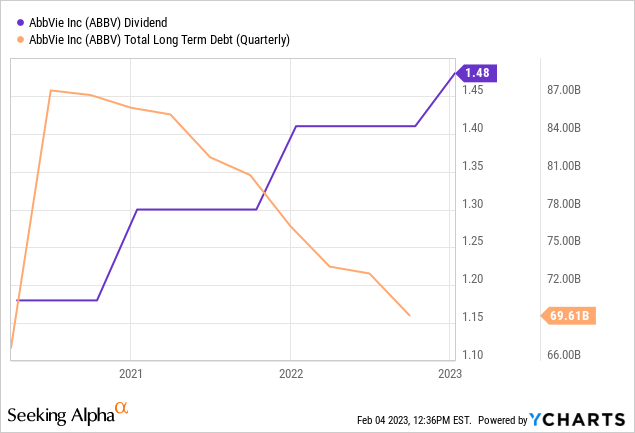

The $63 Billion acquisition was financed with a lot of debt. But management has been effectively paying this down while raising the lucrative dividend, as shown below.

AbbVie has generated $17.5 billion in cash from operations through Q3 2022 and used $7.6 billion to pay down debt and $7.5 for dividends.

Is AbbVie still a buy?

AbbVie was one of my top ideas for long-term investors for 2022, and it has successfully outperformed the S&P 500, although gains have been pared lately. This call is based on the company’s lucrative cash flow, successful growth of drugs like Juvederm, Botox, and Vraylar, massive opportunity with Skyrizi and Rinvoq, and recession-resistant nature.

Uncertainty means opportunity

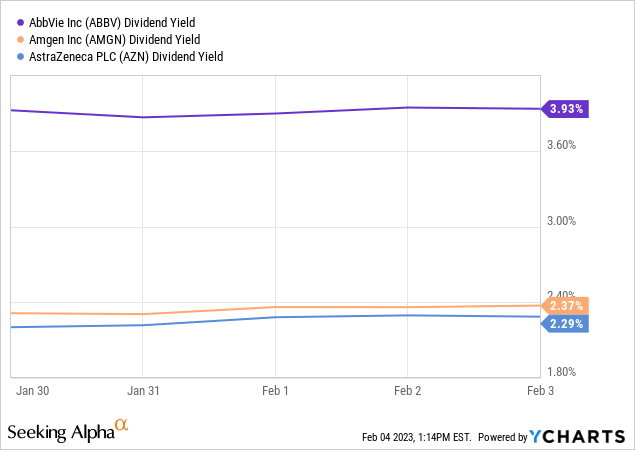

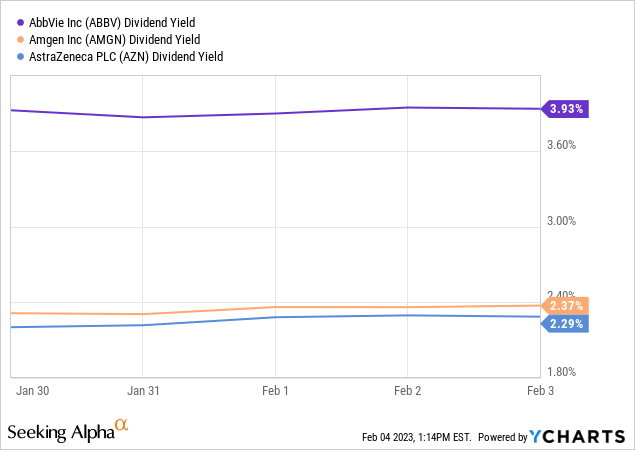

AbbVie investors snag a much higher yield than similar companies because of concerns over future revenues, as shown below.

Investors have received a dividend raise every year since AbbVie’s inception in 2013.

AbbVie still needs help, such as in its Hematologic Oncology portfolio, where Imbruvica and Venclexta sales growth has stalled. The world of pharmaceuticals is highly competitive, and new drugs must come out to replace revenue for those whose patents expire.

The company also has a portfolio of potential drugs to treat everything from Parkinson’s to migraines, along with two blockbusters in the making.

And this is the key to AbbVie’s future.

Raising guidance on Skyrizi and Rinvoq

In early 2022, AbbVie guided for $15 billion in combined sales from Skyrizi and Rinvoq by 2025. Last month, the company raised guidance a whopping 17% to $17.5 billion combined annual sales by 2025 and over $21 billion by 2027 – more than enough to replace lost Humira sales.

Sales of these two grew 67% year over year in Q3 2022 for a run rate of over $8 billion, so the company is well on its way.

I have seen some question this guidance in comments on Seeking Alpha; however, putting out poorly supported guidance could lead to massive legal problems, so companies are careful and usually conservative in their estimates. You can bet that AbbVie’s management has compelling evidence for these estimates.

The long-term macroeconomic opportunity for AbbVie is gigantic with our growing and aging population. It will all come down to execution. And the company has a fantastic track record.

With dividend reinvestments, adding on dips, increases in AbbVie’s stock price, and the decline in many tech names, AbbVie has quietly become one of my most significant holdings, and I have no plans to sell; however, I demand a 4% or greater yield to purchase more.

The recent dip in the share price has pushed the yield over 4% again, making AbbVie a fruitful stock for dividend-growth investors with a bit of risk tolerance.

Published at Sun, 05 Feb 2023 14:00:00 -0800