Societe Generale: A Slowdown Is Expected In 2023

Jean-Luc Ichard/iStock Editorial via Getty Images

Company Overview

Societe Generale (OTCPK:SCGLF) reports results in four main core businesses:

French Retail Banking at about 32.2% of Q4 2022 net banking income, International Retail Banking & Financial Services at 34.4% of Q4 2022 net banking income, Global Banking & Investor Solutions at 35.6% of Q4 2022 net banking income and the Corporate Centre at negative 2.3% of Q4 2022 net banking income.

Operational Overview

French Retail Banking was the weakest segment in the quarter. It delivered a 0.1% annual drop in net banking income in Q4, weaker than the 4.1% increase in 2022. Underlying return on net equity (RONE) was 6.6% in the quarter, again worse than the 11.6% observed in 2022. The main reason for underperformance was a normalizing cost of risk – 45.3% of total 2022 cost of risk was booked in Q4.

On the bright side, online bank Boursorama grew clients by 42.4% in 2022 to almost 4.7 million. That said, it still had a negative impact on French Retail results as RONE would have been 8.4% in the quarter excluding Boursorama.

International Retail Banking & Financial Services was the top performer in the last quarter, with underlying annual net banking income growth of 17.4% in Q4, marginally worse than the 17.9% observed in 2022. Underlying RONE was 24.3% in the quarter, an acceleration to the 22.4% in 2022. Net interest income grew the fastest in the Czech Republic (+33.6%) and Romania (+17.5%) Y/Y.

Global Banking & Investor Solutions was the only segment to observe revenues accelerate into Q4, with underlying net banking income growth of 14.7% in the quarter, stronger than the 12.9% in the full year. Underlying RONE was 15.5% in Q4, slightly below the 16.3% in 2022. Both Equity (+4.7% Y/Y revenue growth) and Fixed Income and Currencies (+38.2%) had a record year.

Corporate Centre recorded 0.63 EUR billion in underlying losses in 2022. It booked 639 EUR million in restructuring charges in 2022 primarily, but no limited to, French Retail.

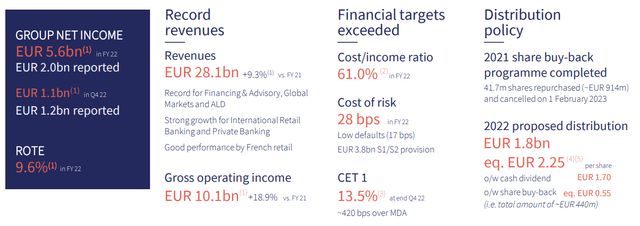

On a Group level Societe Generale delivered a strong 2022:

Societe Generale Q4 2022 Results Presentation

Underlying net banking income grew 6.2% in Q4 Y/Y, slower than the 9.7% growth in 2022. Underlying ROTE was 7.6%, again worse than the 9.6% in 2022.

Cost of risk was 28 basis points in Q4, in line with 2022. Net tangible asset value per share ended 2022 at 62.3 EUR/share, up 1.2 EUR from 2021.

Underlying earnings per share, which exclude primarily the loss on the Russian subsidiary Rosbank sale, were 6.1 EUR/share in 2022, up 10.5% Y/Y. The underlying Cost/income ratio was 61% in 2022, an improvement from the 64.4% in 2021.

The bank estimates its remaining Russian net Exposure at Risk at below 0.6 EUR billion.

For 2022, the company proposes a distribution of 2.25 EUR/share (down 18.1% Y/Y). It consists of a dividend of 1.7 EUR/share (up 3%) and a share buyback of 0.55 EUR/share or 440 million EUR (down 51.9%).

Capital Position

The CET1 ratio improved by 0.4% to 13.5% Q/Q, driven by organic capital generation. It represents a buffer of 420 bps over the bank’s 9.35% Maximum distributable amount (MDA) requirement.

The 2025 target remains at 12% CET1 under Basel IV. In light of the previously communicated circa 110 bps impact from Basel IV implementation, it is fair to say the bank has no surplus capital for additional buybacks outside of organic earnings.

2023 Outlook

ALD, which is in the process of finalizing its LeasePlan purchase in Q1 2023, will announce guidance after the closing of the acquisition.

Boursorama targets 17% client growth to 5.5 million in 2023.

Cost of risk is expected to range between 30 and 35 basis points. I estimate this should result in about 300 million EUR in additional costs relative to 2022.

The Cost/income ratio is expected to deteriorate to 66-68%. Thus I estimate costs are expected to deteriorate by about 2.7 billion EUR (this incorporates increased costs due to revenue growth as well).

If we assume net banking income grows by about 1.5 billion, or 5% in 2023, I estimate costs will deteriorate by 1.5 billion on a net basis. Assuming a 25% effective tax rate, the net effect before minority interests should be about 1.1 billion EUR.

All in all, I expect the bank to deliver some 4.7 billion EUR group share in net income in 2023 based on current forecasts, down from the 5.6 billion in 2022. The ROTE should still land at 8% for the year.

Investment Thesis

Societe Generale targets a 10% ROTE for 2025. After BNP Paribas (OTCQX:BNPQF) increased its ROTE target by 1% to 12%, in line with Credit Agricole (OTCPK:CRARF), Societe Generale remains somewhat of an outlier with its 10% target. Nevertheless, this is more than made up for by the valuation discount. SocGen currently trades at about 0.43 times tangible book, almost half BNP’s 0.8 valuation. I covered its Q3 earnings here.

While there is no near term catalyst on the horizon – the buyback is likely to be executed in H2 2023, SocGen shares already had a strong start of the year and continuing protests in France will impact economic growth and investor sentiment – medium term prospects are promising.

I estimate SocGen will deliver 8% ROTE in 2023 and is in a good position to improve on the result in 2024-2025 driven by the ALD capital increase, reduced restructuring expenses and flow-through of higher rates in French Retail, including a profitable Boursorama.

Thank you for reading.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Published at Wed, 08 Feb 2023 17:03:50 -0800