American Hotel Income Properties: A 10% YTM On Debt Securities, But Not Without Risk

tupungato/iStock Editorial via Getty Images

Introduction

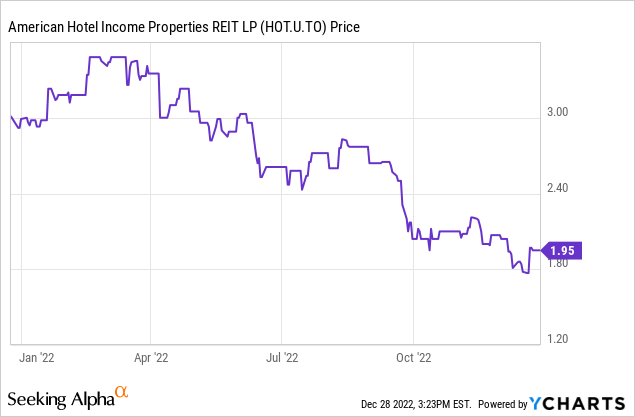

American Hotel Income Properties (OTC:AHOTF) (TSX:HOT.UN:CA) is a Canada-based limited partnership which owns hotel assets in the United States. Offering a distribution yield of in excess of 9%, the partnership appears to be attractive, but as the balance sheet still is a bit shaky, I decided to focus on the partnership’s December 2026 debentures which are listed in Canada and currently offer a 10% yield to maturity.

A small US-focused hotel REIT with a strong FFO and AFFO rebound this year

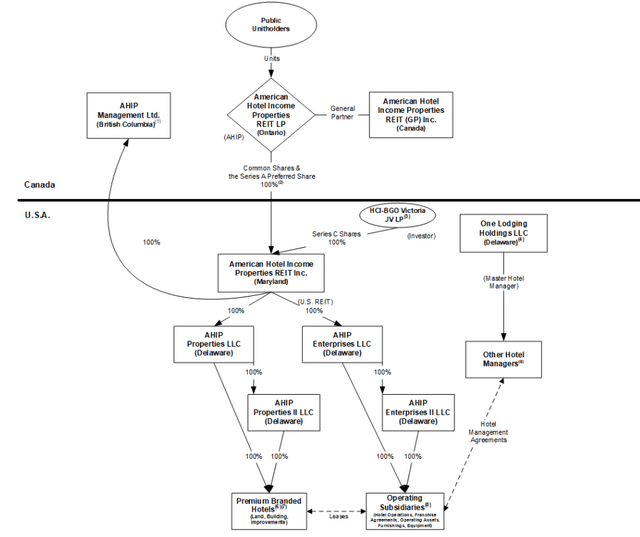

American Hotel Income Properties (here after ‘AHIP’ or ‘HOT’ for simplicity sake) is a Canada-based limited partnership owning the US-bases AHIP REIT Inc. which owns the different subsidiaries.

AHIP Investor Relations

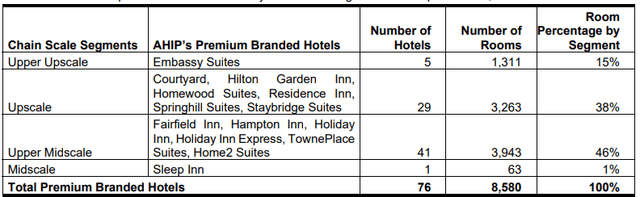

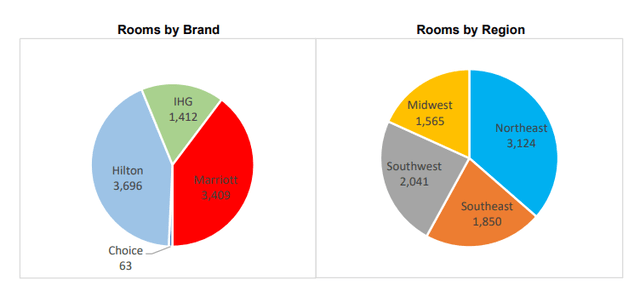

As of the end of September, American Hotel Properties owned 76 hotels with 8,580 guestrooms in 22 states.

AHIP Investor Relations

Almost 40% of the rooms are in the Northeast US, while the largest brand name in the portfolio is Hilton (HLT) with just over 40% of the rooms Marriott (MAR) is only slightly smaller in the portfolio.

AHIP Investor Relations

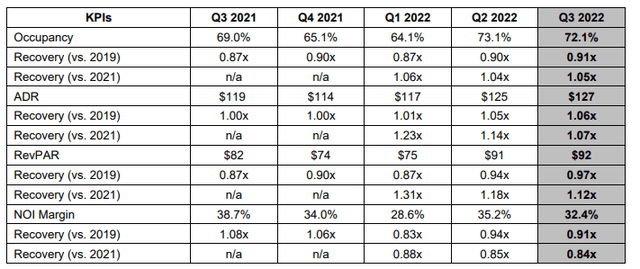

I was pretty surprised to see how resilient the performance of AHIP was in 2021. Although the dividend was suspended during that year as the focus was on keeping the balance sheet healthy, American Hotel Properties generated a diluted AFFO of US$0.46 per unit. That being said, a large portion of the 2021 AFFO performance (in excess of US$0.15 per diluted share) was caused by the non-recurring impact of a government loan that no longer had to be repaid.

And so far, 2022 is shaping up to be a good year as well. The occupancy has almost reached 2019 levels again while the ADR is already higher than in 2019.

AHIP Investor Relations

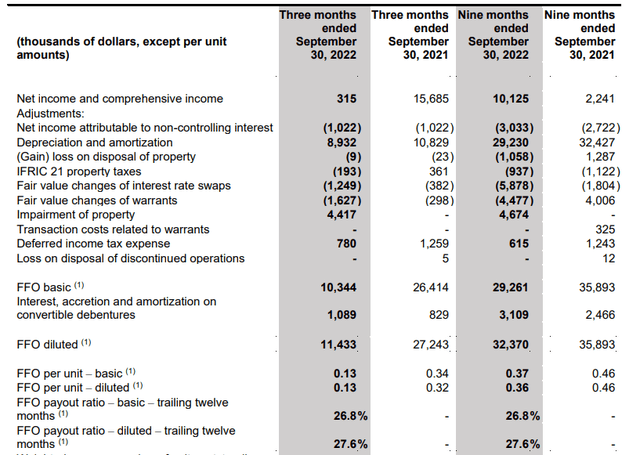

The third quarter was pretty strong again. The Hotel REIT reported an FFO of US$0.13 per diluted share, and this brings the FFO to US$0.37/share in the first nine months of this year, and to US$0.36 on a diluted basis. This means we can likely expect the full-year FFO per unit to come in above US$0.40 (as the fourth quarter should be one of the weaker quarters, and while I’m expecting a positive AFFO, I don’t think it will come anywhere close to the Q3 result). As a reference, the Q4 2021 AFFO was approximately US$0.07 per unit.

AHIP Investor Relations

The AFFO calculation includes about US$3M in capital expenditures, resulting in a basic AFFO of US$0.09 per unit (both on a basic and a diluted basis). The AFFO per share in the first nine months of the year was US$0.27.

American Hotel Income Properties currently pays a monthly distribution of US$0.015 per unit which means that it currently has a payout ratio of approximately 50% based on the first nine months of the year. As I expect the Q4 result to be weaker, the payout ratio based on an anticipated AFFO of US$0.42 per share (assuming a Q4 AFFO of US$0.06/unit) will be approximately 43%. So the distribution should be safe.

Due to recent changes in the US legislation, I prefer the debt securities over being a shareholder

Despite the generous 10% distribution yield and the fact AHIP is trading at just over four times its AFFO, I’m still not inclined to purchase the common units. Unfortunately this hotel-focused partnership seems to fall under the new publicly traded partnership rules and as a non-US resident I’d be required to pay a 10% tax on the sale of units. If I’d sell US$25,000 of units in a year, I’d be on the hook for US$2,500 in taxes whether I make a profit or not.

That makes it less appealing to purchase the units (although I’m not ruling it out as the units are trading at a very low AFFO multiple), but I started to look at the debentures, which are also trading in US dollars on the Canadian exchange.

AHIP Investor Relations

Trading as HOT.DB.V, these debentures mature on Dec. 31, 2026, and offer a 6% yield. But as the debentures are trading at just 87 cents on the dollar, the yield to maturity is approximately 10.02%. Very appealing, especially as it is a debenture and thus a liability which ranks senior to the common units.

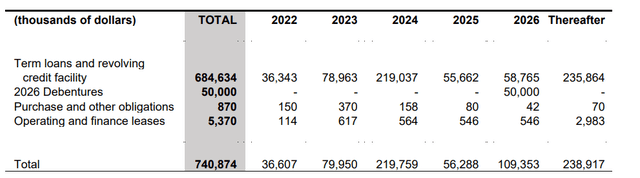

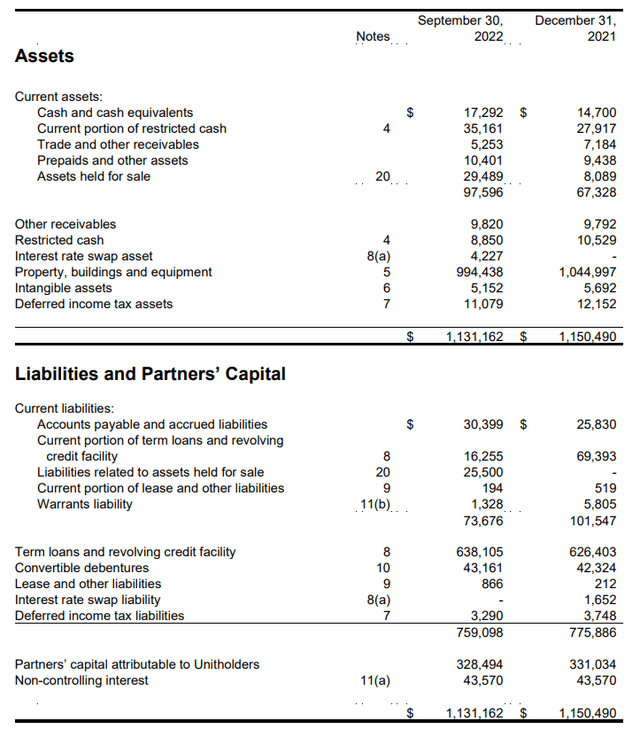

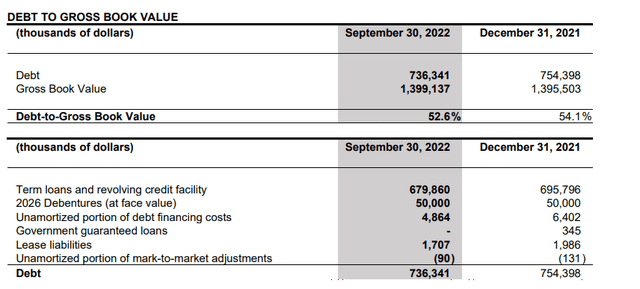

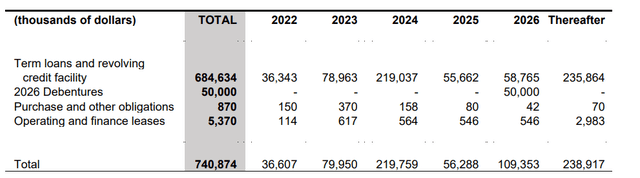

But of course, a 10% YTM is useless if the Partnership risks going under. As of the end of September, AHIP had $17M in unrestricted cash, $16.2M in short-term debt and $681M in long-term debt (note: the total amount of convertible debentures outstanding is US$50M). This means the net debt position is approximately US$690M including the full face value of the convertible debentures. This excludes the restricted cash ($44M) and excludes the net impact of almost US$5M for the sale of properties.

AHIP Investor Relations

This means the LTV ratio based on the book value of the hotel assets is approximately 69%. That’s sky high, but keep in mind the hotel assets already include in excess of $200M in accumulated depreciation. The total gross book value of the assets (book value + depreciation + impairment charges) is approximately US$1.4B which makes the net debt ratio more bearable at just under 50% while the gross debt ratio is just over 50%.

AHIP Investor Relations

The question now is how reliable that US$1.4B gross book value is. Although I’m usually very reluctant to use a gross book value unless there’s an official fair value estimate, I can see why American Hotel Income Properties’ US$1.4B valuation actually makes sense.

The net operating income during the third quarter was approximately US$24.7M and the NOI in the first nine months of the year was $68.8M. Even if the NOI during the fourth quarter would come in at just US$20M, the total NOI would be approximately US$89M for a NOI yield of 6.35% on the gross asset value. That’s a little bit on the lower end but it could be justified if 2023 would be another strong year.

Also keep in mind that if AHIP keeps its distribution unchanged at US$0.015 per month, it will retain about US$0.24 per share per year in AFFO for about US$20M. This will immediately help to reduce the LTV ratio by about 143 basis points per year. Additionally, recent asset sales were somewhat in line with the book value: A portfolio of four non-core hotel assets in Oklahoma is sold for US$26.3M and AHIP had to record a $4.4M impairment charge on this sale indicating the properties are being sold at a discount of 14% to the book value, and likely an even bigger discount to the gross book value.

This means I’m a bit “iffy” on using the gross book value of the hotels, but I do acknowledge AHIP is taking the right steps to reduce its net debt and gross debt. This, in combination with retained cash, should allow the REIT to see its LTV ratio based on the gross book value drop below 50% by the end of next year, but the LTV ratio will remain pretty high based on the book value.

Investment thesis

I’m not too interested in the common units despite seeing them trade at a very low multiple based on the AFFO result, but I think owning the debt could be fine. Of course, the convertible debentures rank junior to all bank debt so if AHIP goes down, even the convertible debentures may not be repaid in full. That being said, I like the partnership’s plan to reduce the debt level to 40-50% of the GBV and I hope we will see the debt level move towards the lower end of that range.

AHIP Investor Relations

2024 will be an interesting year for AHIP as it will need to refinance US$220M in debt. As a reminder, the convertible debentures mature in 2026, which means almost $240M of the total gross debt matures after the maturity date of the convertible debentures. I expect AHIP to be able to refinance its debt as it comes due although the average interest rates to do so will likely increase. This will weigh on the AFFO and the ability to retain cash, but select asset sales should also free up additional cash.

I have a very small speculative position in AHIP’s convertible debentures. I would consider adding to this position if the balance sheet gets a little bit safer but for now, I’m comfortable with my small position.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Published at Sat, 31 Dec 2022 08:45:00 -0800