SoFi Technologies: Should You Buy The Dip?

ArtistGNDphotography

SoFi Technologies (NASDAQ:SOFI) has improved its business fundamentals in recent quarters, a profile that is not reflected in its valuation. Its stock has been quite weak and reached its all-time lows recently, providing a good buying opportunity for long-term investors.

Background

As I’ve analyzed in a previous article, while SoFi has some good growth prospects over the coming years, I don’t think the company has any competitive advantage in the fintech industry and some of its ambitions are clearly exaggerated. For instance, management’s comments that it wants to be in the fintech industry what Amazon (AMZN) Web Services is in the technology industry aren’t, in my opinion, realistic.

This happens because barriers to entry and product differentiation is rather low in the fintech industry and SoFi likely knows that, trying to differentiate itself from a better customer service than competitors. Therefore, I think SoFi may have an interesting position in the “neobank” segment, and can grab some market share from traditional banking competitors in the future, but I don’t see SoFi becoming a leading company in the U.S. financial industry for the foreseeable future.

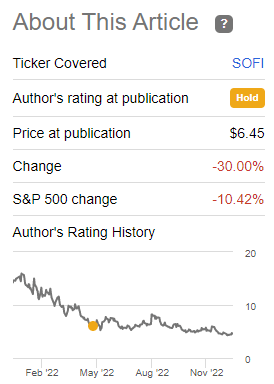

Since my article on SoFi back in April, its stock has dropped by close to 30%, clearly underperforming the S&P 500 Index, as investors punished the company’s lack of profits, plus the increased prospects of a recession aren’t good for its business, even though the company’s most recent financial performance has been relatively positive.

Sofi performance (Seeking Alpha)

SoFi Technologies Q3 Earnings

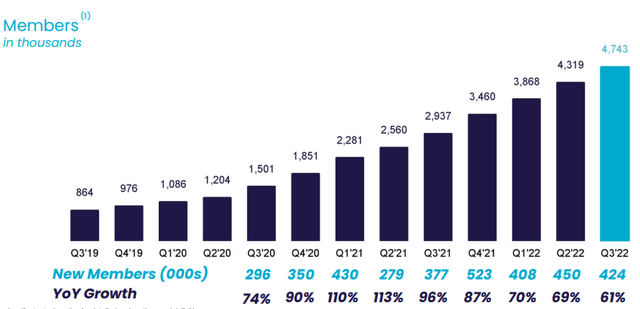

Since my last article, SoFi has maintained a solid growth path, reporting a higher number of members, products, and higher financial figures. Indeed, SoFi remains on a strong growth path, even though due to its larger size its customer growth rate is gradually decreasing. At the end of Q3, SoFi’s total customers amounted to more than 4.7 million, an increase of 61% YoY.

Customers (Sofi)

This shows that SoFi’s strategy to expand its product offering and be a one-stop shop for financial services has been the right one, as the company has consistently grown its customer base over the past three years.

As SoFi now has a banking license, following its acquisition of Golden Pacific Bancorp that was completed back in February 2022, it can now offer a wider range of products, of which deposits are probably the most important; one because it expands the company’s funding sources and two because it reduces its exposure to wholesale funding.

Indeed, when looking at SoFi’s balance sheet, its liabilities at the end of 2021 were mainly long-term borrowings in the amount of around $4 billion, while at the end of Q3 2022 its funding mix has improved significantly given that it had more than $5 billion in deposits and close to $4.7 billion in long-term borrowings.

This makes a difference in the company’s business model and funding costs, considering that deposits usually have a lower cost than debt and are considered to be a stable form of funding over the long term, making SoFi more competitive against other specialty finance companies and even compared to small-sized banks. Indeed, the company says that it has achieved about 125 basis points of savings on the cost of funds through deposits, compared to other sources of debt to fund loans.

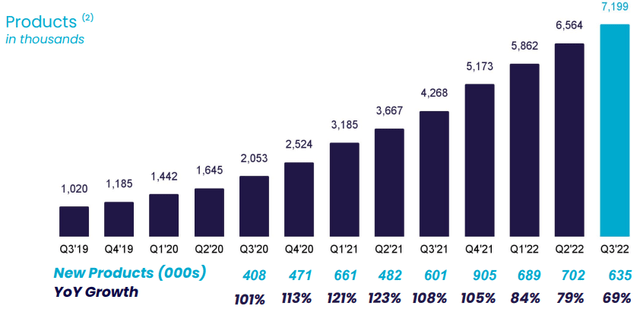

This increased competitiveness is another reason for the company to maintain a positive trend of higher product penetration among its customer base, together with higher customer engagement, enabling it to increase the number of products at a higher rate than customer growth in recent quarters, to a total of close to 7.2 million products at the end of Q3 2022.

Products (Sofi)

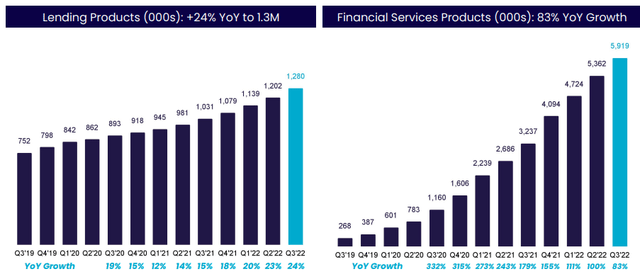

While the company’s roots are on lending, specifically student loans, where the company is growing much faster is related to financial services products, which include investing, banking, insurance, and even crypto. As shown in the next graph, this segment has been SoFi’s major growth engine, a trend that is likely to persist in the future.

Financial Services (Sofi)

Due to the combination of higher number of customers and expanded products, SoFi’s revenue increased to $419 million in Q3 (+51% YoY), reaching a new quarterly record. Its profitability also improved markedly, considering that its adjusted EBITDA was $44 million in the last quarter, a great improvement from $20 million in Q2 2022, and only $10 million in Q3 2021.

However, based on GAAP figures, SoFi’s operations reported a net loss of $74 million in Q3, and about $280 million during the first nine months of 2022. This is lower than its operating loss of $373 million during the first nine months of 2021, showing that SoFi is on the right path to achieve profitability, based on GAAP, over the next few years.

Due to these positive results, the company slightly raised its guidance for the full year, expecting now to reach annual revenue of around $1.52 billion, and adjusted EBITDA between $115-120 million. This is much better than its initial guidance of an adjusted EBITDA loss of $160 million for 2022, showing that SoFi’s operating momentum and profitability has clearly improved in recent quarters.

From an operating perspective, in my opinion, the monetization of its customer base and product offering is key for the sustainability of its long-term growth strategy, a situation that has clearly improved in the past few months. This is justified to some extent by its banking license and more diverse funding mix, which has improved its lending margins and its liquidity position, enhancing the sustainability of its business model.

While the company can still be considered to be in an early-growth phase, I think it is now more likely that SoFi will eventually reach profitability on a GAAP basis in the next couple of years, which would be a great milestone for the company. Note that excluding share-based compensation (‘SBC’) of $78 million in Q3 2022, Sofi would be already slightly profitable on a GAAP basis (reported loss of $74 million), but as a technology company SBC is not expected to decrease soon and therefore GAAP profitability is not expected to be achieved in the next few quarters.

SOFI Stock – Medium-Term Estimates & Valuation

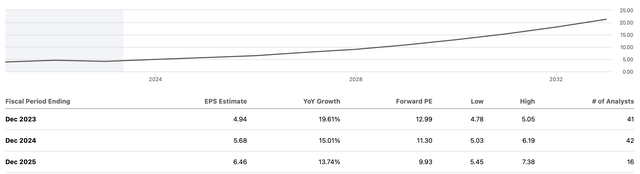

Looking at Street estimates, the market also isn’t expecting SoFi to become profitable on a GAAP basis in the short term, given that net income is only expected to be slightly positive in Q2 2024. On an annual basis, only by 2025 it is estimated that SoFi will report a positive net income (GAAP) of about $47 million on revenue of around $3.3 billion.

This means that even though revenue is expected to more than double over the next three years, as the company continues to invest in business growth, its expenses are also likely to increase significantly. This seems to be a reasonable assumption, considering that SoFi will certainly continue to invest in technology to improve its product offering, and the fact that it now has a bank charter is likely to lead to more regulation and higher compliance costs, as the company’s size continues to increase.

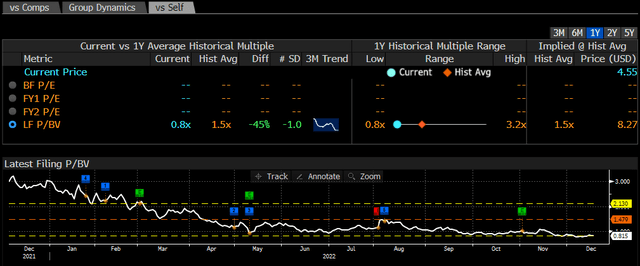

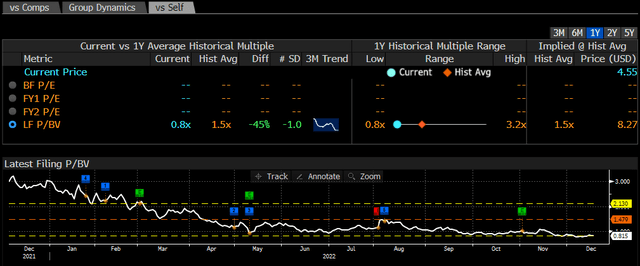

Regarding its valuation, even though SoFi is a fintech company, the fact that it has a bank license and its balance sheet is now more similar to banks, as the liabilities side is now funded by a mix of deposits and debt, in my opinion, the best way to value it is as a financial institution rather than a technology company.

Therefore, as SoFi currently doesn’t have profits and its business is gradually becoming more geared to banking, I see the price-to-book value ratio as the best metric to value it.

As can be seen in the next graph, like many growth stocks, SoFi has de-rated considerably from its highs reached at the end of 2021, and now has a much more reasonable valuation. When I last wrote about SoFi it was trading at 1.2x book value, but currently it’s trading at only 0.8x book value, which seems quite low for a company that is growing quite rapidly and has improved its profitability in recent months.

Valuation (Bloomberg)

As SoFi is trading at a relatively low valuation and has recently reached its 52-week lows, its management also seems to consider the stock as undervalued, given that SoFi’s CEO has recently purchased some $5 million in common stock. This is another positive sign that SoFi’s share price may have recently reached its bottom, as the company’s fundamentals have improved in the past few quarters and this doesn’t seem to be reflected in its valuation.

Conclusion

SoFi has improved its fundamentals in recent months, maintaining a strong growth path, higher profitability and a stronger balance sheet with funding now coming significantly from deposits. Despite this backdrop, its share price has been quite weak and reached its all-time lows recently, leading to mispricing. SoFi seems to be undervalued right now and is a good growth play on the fintech investment theme for long-term investors.

Published at Fri, 16 Dec 2022 09:47:31 -0800