Stocks Reverse Momentum – Week in Review

Stocks Reverse Momentum

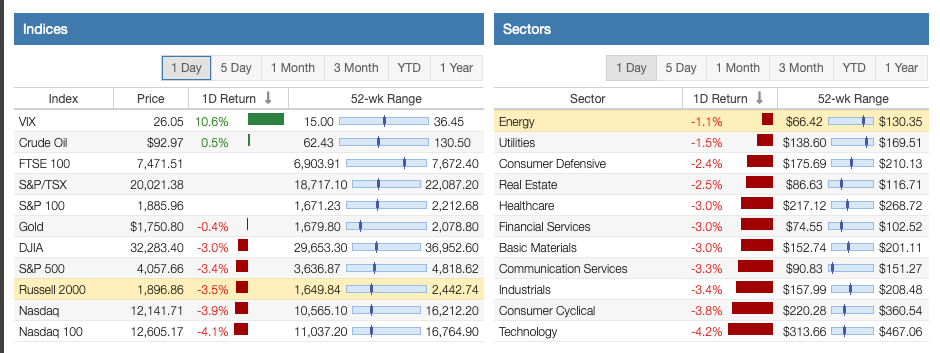

The US Federal Reserve Chair, Jerome H. Powell, spoke at Jackson Holy, WY and stocks shuddered on Friday and reversed momentum. Some energy stocks had a positive return because oil prices increased, while a few others rose because of positive news. Furthermore, none of the eleven sectors had a positive return, although according to Stock Rover*, the Energy sector was up for the week. So what exactly caused recent stock market momentum to reverse after Powell spoke?

It’s Inflation, Inflation, Inflation

The main problem is inflation, inflation, and more inflation. It is not a unique problem to America but a global problem of too much demand and not enough supply combined with loose monetary policy. Furthermore, the war in Ukraine and China’s mismanagement of the COVID-19 pandemic have caused economic slowdowns or downturns in Ukraine, Russia, and China.

Focusing on the US, inflation seemingly peaked in June 2022 based on the Consumer Price Index (CPI), going from 8.9% in June to 8.5% in July. The consumer price index (CPI) is a metric that measures the average price changes of a basket of consumer goods and services.

On Friday, the Personal Consumption Expenditure (PCE) report was only 6.3%, down from last month, and the core number was 4.6%, the lowest value in the past five months. Still, this is higher than the 2% target by the Fed.

Fed’s Response

In response to the PCE reading at the Jackson Hole, WY meeting, Chairman Powell stated:

The Federal Open Market Committee’s (FOMC) overarching focus right now is to bring inflation back down to our 2 percent goal. Price stability is the responsibility of the Federal Reserve and serves as the bedrock of our economy. Without price stability, the economy does not work for anyone. In particular, without price stability, we will not achieve a sustained period of strong labor market conditions that benefit all. The burdens of high inflation fall heaviest on those who are least able to bear them.

Restoring price stability will take some time and requires using our tools forcefully to bring demand and supply into better balance. Reducing inflation is likely to require a sustained period of below-trend growth. Moreover, there will very likely be some softening of labor market conditions. While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain.

The text of Powell’s response contains more insight, and you should read it. However, a 0.75% increase is possible; indeed, a 0.50% is probable. The FedWatch Tool gives a 39% chance of a 0.50% increase and a 61% probability of a 0.75% increase.

Ultimately, the Fed is aggressively trying to lower inflation and prevent it from being persistent. They are applying lessons learned during the 1970s and 1980s when high inflation lasted for years because of the Vietnam War and the US dollar coming off the gold standard.

Many expected a less hawkish Fed; thus, stock market momentum reversed after Powell spoke at Jackson Hole.

Final Thoughts on Stocks Reverse Momentum

The saying “Don’t Fight the Fed” holds true. Instead, investors should align their investment strategy with the Fed’s macroeconomic view and interest rate actions. The Fed is tightening and reducing the size of its balance sheet. As a result, risk assets will likely perform poorly, while less risky asset classes will perform better. Consequently, cryptocurrencies and growth stocks struggle, while value stocks and risk-free investments perform better. If you are savingfor retirement, focus on quality.

Another asset class that does well is Series I Bonds, a type of US Government savings bonds. They have a feature where their interest rates rise when inflation increases. Series I Bonds are an excellent way to save for the future.

Affiliate

Dividend Power has partnered with Sure Dividend, one of the best newsletters for dividend stock investing. The newsletter comes out monthly and highlights their top 10 picks. A lot of effort goes into analyzing hundreds of stocks, doing much of the work for you. They have over 9,000 subscribers, and it grows every month.

Sign up for the Sure Dividend Newsletter*. You can also use the Sure Dividend coupon code DP41off. The regular price for Sure Dividend Newsletter* is $199 per year and the reduced price through this offer is $158 per year. There is a 7-day free trial and refund grace period as well. So, there is no risk.

If you are interested in higher-yielding stocks from the Sure Retirement Newsletter*, the same coupon code, DP41off, gives ~25% or $41 off. The regular price of the Sure Retirement Newsletter* is $199 and the reduced price through this offer is $158 per year.

If you are interested in buying and holding stocks with a rising income from the Sure Passive Income Newsletter*, the same coupon code, DP41off, gives ~25% or $41 off. The regular price of the Sure Passive Income Newsletter* is $199 and the reduced price through this offer is $158 per year.

The Stock of the Week

Today we highlight VF Corporation (VFC), the clothing and footwear retailer. According to Stock Rover*, the stock price was down ~42.7% this year and nearly 45% in the past 1-year, making it one of the worst-performing Dividend Aristocrats. In addition, the company missed earnings per share estimates and faced many challenges: high commodity costs, a strong dollar, retailers with increased inventory, and low consumer confidence with high inflation. Unfortunately, many of these issues cannot be controlled by the VFC.

The dividend yield is elevated at about 4.86%, the highest in the past decade and well over the 5-year average of about 2.64%. Next, Verizon is a Dividend Aristocrat and Dividend Champion and, according to Dividend Radar, has 48 years of dividend increases. The year 2022 and possibly part of 2023 will be challenging until the Fed pivots on rate increases. However, the stock is a decent one or the long term.

Dividend Increases and Reinstatements

Search for a stock in the list of dividend increases and reinstatements. This list is updated weekly. In addition, you can search for your stocks by company name, ticker, and date.

Dividend Cuts and Suspensions List

The dividend cuts and suspensions list was most recently updated at the end of July 2022. As a result, the number of companies on the list has risen to 563. Thus, well over 10% of companies that pay dividends have cut or suspended them since the start of the COVID-19 pandemic. The list is updated monthly.

Three new additions indicate companies are experiencing solid profits and cash flow in July.

The new additions were Rio Tinto (RIO), Industrial Logistics Properties (ILPT), and Franklin Street Properties (FSP).

Market Indices

08/27/22

Dow Jones Industrial Averages (DJIA): 32,283 (-4.22%)

NASDAQ: 12,142 (-4.44%)

S&P 500: 4,058 (-4.04%)

Market Valuation

The S&P 500 is trading at a price-to-earnings ratio of 20.5X, and the Schiller P/E Ratio is about 30.4X. These multiples are based on trailing twelve months (TTM) earnings.

Note that the long-term means of these two ratios are approximately 16X and 17X, respectively.

The market is still overvalued despite the recent market correction and a bear market. Earnings multiples of more than 30X are overvalued based on historical data.

S&P 500 PE Ratio History

Shiller PE Ratio History

Stock Market Volatility – CBOE VIX

This past week, the CBOE VIX measuring volatility was down about 5.0 points to 25.56. The long-term average is approximately 19 to 20. The CBOE VIX measures the stock market’s expectation of volatility based on S&P 500 Index options. It is commonly referred to as the fear index.

Yield Curve

The two yield curves shown here are the 10-year US Treasury Bond minus the 3-month US Treasury Bill from the NY York Fed and the 10-year US Treasury Bond minus the 2-year US Treasury Bond from the St. Louis Fed.

Inversion of the yield curve has been increasingly viewed as a leading indicator of recessions about two to six quarters ahead, according to the NY Fed. The higher the spread between the two interest rates, the higher the probability of a recession.

Economic News

The US Census Bureau reported that new home sales decreased to 12.6% below the revised number in June. The recent home sales in June were revised down to 585,000 from 590,000. July’s seasonally adjusted rate is 511,000 units. Sales decreased in the West (-13.3%), South (-12.1%), and Midwest (-20.6%), while the Northeast increased (13.3%). The median new house price is 10.7% higher than last year at $439,400; the average sale price was $546,800.

The US Census Bureau reported that new orders for durable goods decreased by less than $0.1 billion to $273.5B in July, virtually unchanged from June. This slight decrease follows four consecutive monthly increases, including a 2.2% increase in June. Total durable-goods orders are up 10.8% year over year. Bookings for motor vehicles increased slightly by 0.2% after a 1.7% increase the previous month. Excluding defense, new orders increased by 1.2%.

The US Energy Information Administration reported that US commercial crude oil inventories increased by 3.3M barrels to 421.7M (6% below the five-year average) on August 19th. Crude oil refinery inputs averaged 16.3M barrels per day, a decrease of 168K per day compared to the previous week’s average. Gasoline inventories decreased slightly (7% below the five-year average). Refineries operated at 93.8% of their operable capacity.

Thanks for reading Stocks Reverse Momentum – Week in Review!

Here are my recommendations:

If you are unsure how to invest in dividend stocks or are just getting started with dividend investing. Please look at my Review of the Simply Investing Report. I also provide a review of the Simply Investing Course. Note that I am an affiliate of Simply Investing.

If you are interested in an excellent resource for DIY dividend growth investors. I suggest reading my Review of The Sure Dividend Newsletter. Note that I am an affiliate of Sure Dividend.

If you want a leading investment research and portfolio management platform with all the fundamental metrics, screens, and analysis tools you need. Read my Review of Stock Rover. Note that I am an affiliate of Stock Rover.

If you would like notifications about when my new articles are published, please sign up for my free weekly e-mail. You will receive a free spreadsheet of the Dividend Kings! You will also join thousands of other readers each month!

*This post contains affiliate links meaning that I earn a commission for any purchases that you make at the Affiliates website through these links. This will not incur additional costs for you. Please read my disclosure for more information.

Published at Sun, 28 Aug 2022 04:00:00 -0700