Acadia: Powerful Unfolding Catalysts

PALMIHELP Acadia

If you aren’t willing to own a stock for 10 years don’t even think about owning it for 10 minutes. – Warren Buffett

In biotech investing, a regulatory binary event is crucial to your investment thesis. As such, it’s important that you analyze the potential outcomes whenever your company is facing an event like an upcoming FDA decision. After all, a regulatory approval usually strengthens the company’s fundamentals. Now, certain non-approval does not detract much from the investment thesis. As you analyze such a development, you’d know whether you should sell, hold, or add more shares.

That being said, Acadia Pharmaceuticals (NASDAQ:ACAD) recently witnessed substantial changes on the regulatory fronts for its two stellar drugs (Nuplazid and trofinetide). In this research, I’ll feature a fundamental analysis of Acadia and share with you my expectation of this stellar growth equity.

StockCharts

Figure 1: Acadia Pharmaceuticals chart

About The Company

As usual, I’ll provide a brief overview of the company for new investors. If you’re familiar with the firm, I recommend that you skip to the subsequent section. I noted in the prior article,

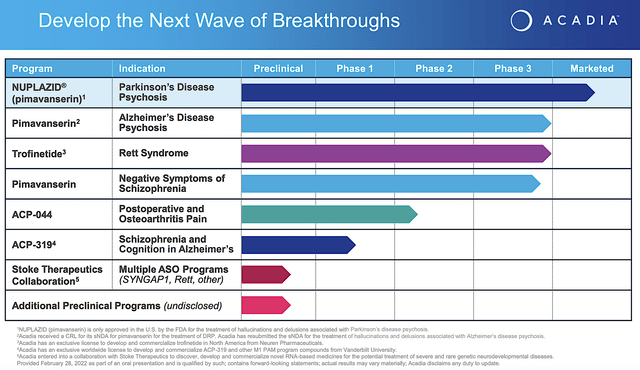

Operating out of San Diego California, Acadia Pharmaceuticals is focused on the innovation and commercialization of medicines to serve the unmet needs of various central nervous system (i.e., CNS) diseases. As the crown jewel of the pipeline, pimavanserin (i.e., Nuplazid) is already approved and successfully launched as an atypical neuroleptic for Parkinson-related psychosis. As an inverse agonist and antagonist of the serotonin receptors, 5-HT2A (and to a lesser extent 5-HT2C), Nuplazid offers a unique approach to treating this condition. Beyond Parkinson’s, Acadia is expanding Nuplazid’s label for psychosis related to Alzheimer’s disease as well as negative symptoms associated with schizophrenia. There are also other pipeline molecules to deliver sustained growth in the coming years.

Acadia

Figure 2: Acadia pipeline

Nuplazid for Alzheimer’s Disease Psychosis

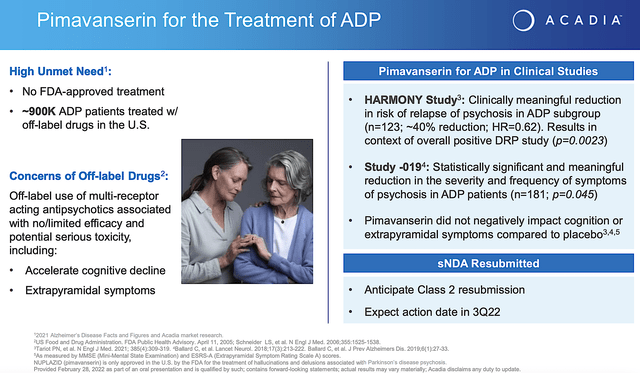

Shifting gears, let us focus on the latest Nuplazid developments. Riding on the robust Nuplazid data, Acadia resubmitted their application with the FDA and had the expected Prescription Drug User Fee Act (i.e., PDUFA) date set for August 4. In a surprising turn of events, Acadia announced that the Psychopharmacologic Drugs Advisory Committee (PDAC) voted 9 to 3 that there is not sufficient data to approve Nuplazid for Alzheimer’s disease psychosis (i.e., ADP). Commenting on the development, the CEO (Steve Davis) remarked,

We are disappointed with the outcome of today’s vote. We will continue to work closely with the FDA as it completes its review of the totality of our efficacy and safety data to enable a full assessment of pimavanserin’s benefit-risk in patients with ADP. We continue to believe there is substantial evidence across multiple independent clinical studies and endpoints that support the efficacy of pimavanserin in ADP. There are no FDA-approved treatments for this critical public health need and off-label use of multi-receptor-acting antipsychotics has demonstrated poor patient outcomes, including worsening of cognition and motor function.

Facing the aforesaid development, you might be wondering what would be the outcome of Nuplazid for ADP. Well, I believe there are two scenarios going forward. And, I’m going to share with you my probability analysis for each event accordingly. In the first situation, Nuplazid would still be FDA approved on August 4th which is the PDUFA date. You might question, how is that the case when PDAC (i.e., the expert committee) already voted against approval?

As you can see, the FDA “usually but NOT always” follows recommendations from their expert committees. You saw the FDA went against their committee to approve Biogen’s (BIIB) Alzheimer’s drug (i.e., Aduhelm). Now, Aduhelm data did not provide clear-cut efficacy. As you’ll later see, Nuplazid provided very strong and convincing data.

That being said, if the FDA is to approve Nuplazid for Alzheimer’s (and I believe the Agency should), there are two factors that strongly supports approval. If you recall, the PDAC votes were NOT a unanimous no. A third of the committee members voted for approval. In my opinion, the 9 members voiced against marketing authorization because the Aduhelm controversy made them skittish on approving any Alzheimer’s drug.

Coming back to the three members who voted in favor, why did they give Nuplazid the nod? In my view, the strong efficacy and safety were certainly there. Moreover, these members realized that there is no safe/efficacious treatment option available for ADP. In light of the dire need for a drug to treat a serious condition (i.e., ADP), you can imagine that it’s a no-brainer to approve a great drug. I noted in the prior research,

From the figure below, you can appreciate that Nuplazid proved clinically meaningful reduction in risk of relapses in ADP. In Study019, Nuplazid demonstrated the reduction in severity and frequency of disease symptoms. Given that the p-values are all less than 0.05%, you know that efficacy is real rather than random occurrences. Coupled with the fact that there is no FDA-approved medicine for ADP, you can bet that Nuplazid is in a great position to capture a monopoly.

Acadia

Figure 3: Nuplazid for Alzheimer’s dementia psychosis

Of Nuplazid safety, the drug was already approved in 2016 for Parkinson’s disease psychosis (i.e., PDP). Six years worth of safety data on the market speaks volumes for Nuplazid. After all, this is not something completely new and unproven like Aduhelm. In my opinion, denying the patients this life-changing drug would be doing them a disservice.

Now that you already see the argument for approval, let us analyze the potential non-approval. As you can see, there is much uncertainty relating to FDA decisions in recent years. Consequently, you have to account for that variable. On this note, it’s likely that the FDA nowadays is inclined to either delay or issue a non-approval initially. It’s like punting the football further along the field.

You can look at it as a way for the Agency to cover itself from liability. Nevertheless, that comes at the expense of the patients from getting their much-needed therapeutics. If the initial negative scenario occurs, the FDA would likely ask Acadia to run another clinical trial before approval. But ultimate approval is highly likely.

Looking ahead, I forecasted that Nuplazid now has a 60% chance of approval for ADP and a 40% initial non-approval with the FDA asking for another clinical trial. The lower approval probability is due to the mixed PDAC votes. As you can appreciate, I based my forecasting on decades of forecasting experience, my intuition, familiarity with the FDA environment, and available data.

Trofinetide for Rett Syndrome

Imagine if non-approval would occur, Nuplazid is still approved for PDP while being assessed for another indication (i.e., negative symptoms associated with schizophrenia). Putting it another way, Acadia can afford for Nuplazid to take a negative regulatory event. But if approval occurs, that’ll be a great value addition to the Nuplazid franchise.

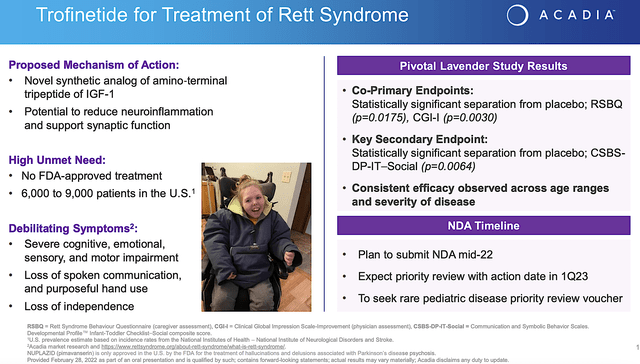

Beyond the Nuplazid, I now realized that trofinetide has become a much more lucrative prospect for Acadia. In other words, trofinetide already cleared the Phase 3 (LAVENDER) study with flying colors. Precisely speaking, trofinetide passed both primary (i.e., RSBG) and secondary (i.e., CSBS) endpoints with strong statistical significance. As a synthetic version of the amino-terminal of the growth hormone IGF-1, trofinetide has the potential to reduce the damaging inflammatory process in the brain which explicated its efficacy.

Viewing the figure below, you can appreciate that Rett syndrome ironically has a huge market. Despite its small prevalence (i.e., 6K to 9K patients in the U.S.), it’s an “orphan or rare” condition. Therefore, a drug for Rett syndrome warrants a premium reimbursement. Given that there is no FDA-approved treatment for Rett, the demand and reimbursement for trofinetide are quite robust.

Acadia

Figure 4: Trofinetide for Rett syndrome

On the regulatory front, Acadia announced (on June 18) that the company already submitted a New Drug Application (i.e., NDA) to the FDA for trofinetide use in adults and kids (at least 2 years or older). Interestingly, the company also seeks a rare pediatric disease voucher for priority review. If the company can earn the voucher, they have the option to sell it for roughly $60M to strengthen their cash position. Commenting on the aforementioned development, the CEO (Steve Davis) enthused,

This is an important step forward for members of the Rett community who face a devastating disease with no approved therapies. We are grateful to the patients, their families, and the physicians who have participated in the trofinetide clinical studies, including our pivotal Phase 3 LAVENDER study. We look forward to working with the FDA as it evaluates the NDA.

As this approval of trofinetide should be straightforward, I ascribed a 65% (i.e., more than favorable) chance of success. The Lavender study posted clear and highly convincing results. In my opinion, this approval would add substantial revenue for Acadia as early as next year due to its orphan designation.

Competitor Landscape

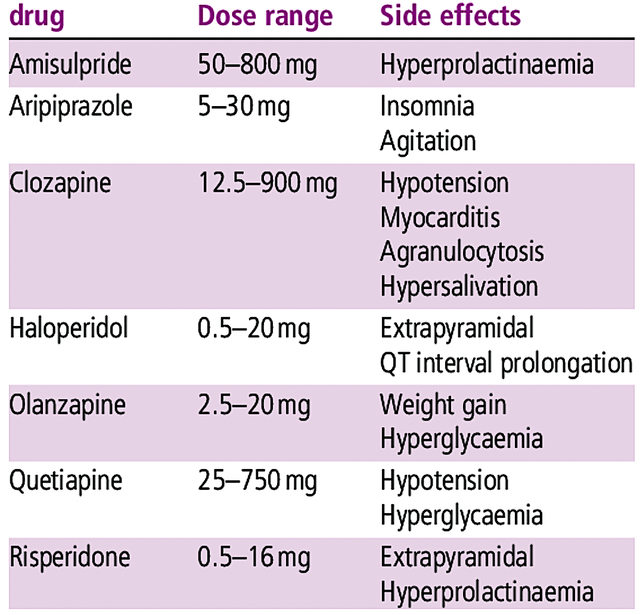

About competition, Acadia’s medicines go toes to toes with conventional neuroleptics like risperidone (Risperdal), quetiapine (Seroquel), olanzapine (Zyprexa), ziprasidone (Zeldox), paliperidone (Invega), aripiprazole (Abilify) and clozapine (Clozaril). I noted in the prior article,

Most of these drugs have substantial adverse effects that limit their utility. For example, patients taking these drugs for the long term can start to produce milk (i.e., prolactinoma).

Acadia

Figure 5: Conventional neuroleptics (Source: ResearchGate)

Moreover, Acadia’s molecules face stronger competitors, including Caplyta of Intra-Cellular Therapies (ITCI) and AXS05 of Axsome Therapeutics (AXSM). Asides from being novel medicines, they posted extremely robust efficacy/safety while having a differentiated profile. Despite the competition, Nuplazid is also highly differentiated. And, there is plenty of room in this niche for many blockbusters.

Financial Assessment

Just as you would get an annual physical for your well-being, it’s important to check the financial health of your stock. For instance, your health is affected by “blood flow” as your stock’s viability is dependent on the “cash flow.” With that in mind, I’ll analyze the 1Q 2022 earnings report for the period that ended on March 31.

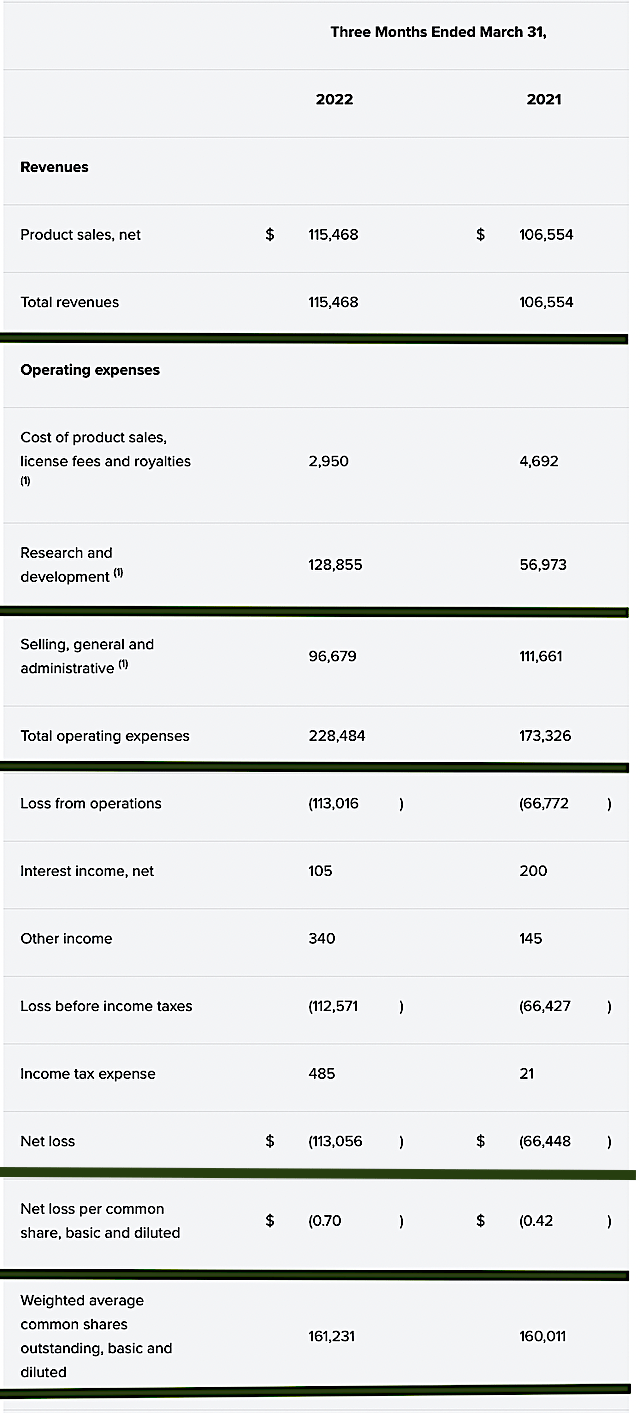

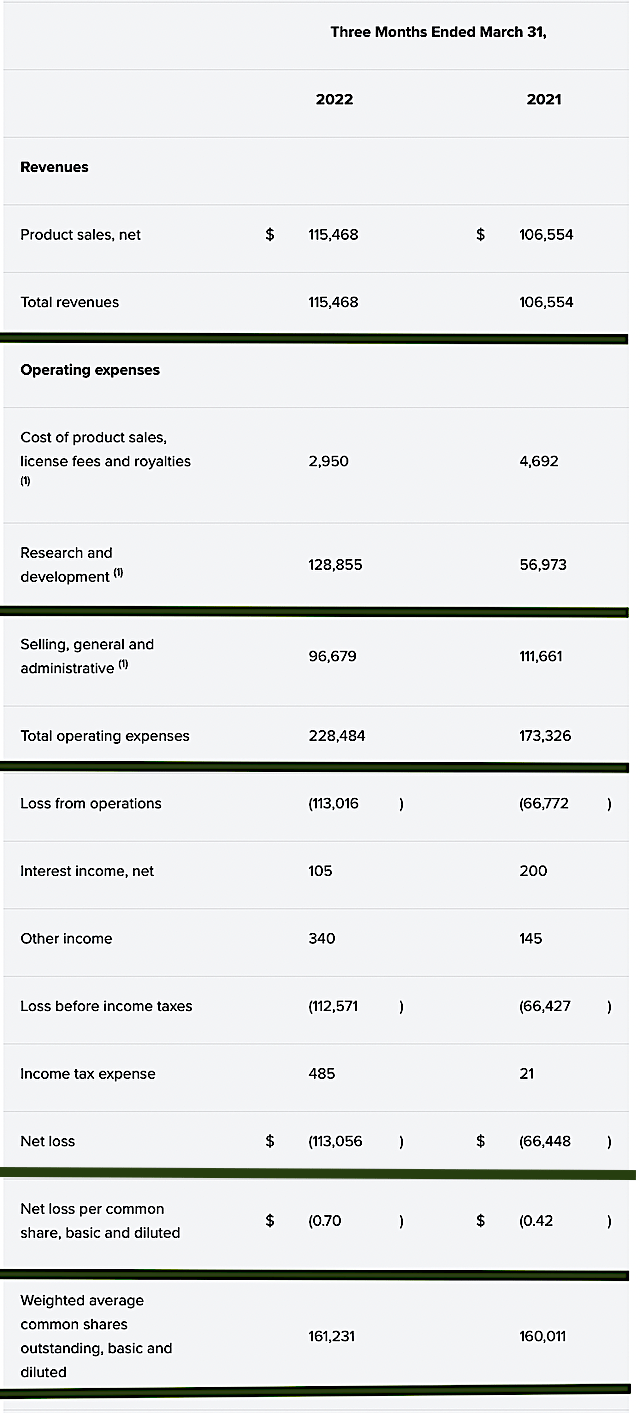

As follows, Acadia procured $115.4M in revenues, all of which came from Nuplazid sales. Compared to $106.5M revenue for the same period a year prior, Acadia’s topline grew by 8.35% year-over-year (YOY). That aside, the research and development (R&D) for the respective periods registered at $56.9M and $128.8M. I viewed the 126.3% R&D increase positively because the capital invested today can turn into blockbuster profits tomorrow. After all, you have to plant a tree to enjoy its fruits.

Additionally, there were $113.0M ($0.70) net losses versus $66.4M ($0.42 per share) net declines for the same comparison. As you can see, the widening bottom line depreciation is due to the higher R&D investment. Though it incurs the losses today, the investment would be translated into a net income in the future.

Acadia

Figure 6: Key financial metrics

Regarding the balance sheet, there were $446.0M in cash, equivalents, and investments. Against the $228.4M quarterly OpEx and on top of the $115.4M quarterly revenue, there should be adequate capital to fund operations into 1Q2023 without the need for additional financing. Simply put, the capital is adequate relative to the burn rate.

While on the balance sheet, you should check to see if Acadia is a “serial diluter.” After all, a company that is serially diluted will render your investment essentially worthless. Given that the shares outstanding increased from 160.0M to 161.2M, my math reveals a 0.7% annual dilution. At this rate, Acadia easily cleared my 30% cutoff for a profitable investment.

Valuation Analysis

It’s important that you appraise Acadia to determine how much your shares are truly worth. Before running our figure, I’d like to share with you the following:

Wall Street analysts typically employ a valuation method coined Discount Cash Flows (i.e., DCF). This valuation model follows a simple plug-and-chug approach. That aside, there are other valuation techniques such as price/sales and price/earnings. Now, there is no such thing as a right or wrong approach. The most important thing is to make sure you use the right technique for the appropriate type of stocks.

Given that developmental-stage biotech has yet to generate any revenues, I steer away from using DCF because it is most applicable for blue-chip equities. For developmental biotech, I leverage the combinations of both qualitative and quantitative variables. That is to say, I take into account the quality of the drug, comparative market analysis, chances of clinical trial success, and potential market penetration. For a medical diagnostic device, I focus on market penetration and sales. Qualitatively, I rely heavily on my intuition and forecasting experience over the decades.

|

Molecules and franchises |

Market potential and penetration |

Net earnings based on a 25% margin |

PT based on 160.8M shares outstanding and 10 P/E |

“PT of the part” after appropriate discount |

|

Nuplazid for Parkinson’s psychosis |

$1B (Estimated from the $11.5B global Parkinson’s disease market) |

$375M | $23.32 | $20.99 (10% discount because Nuplazid is succeeding in launch) |

| Nuplazid for Alzheimer’s disease psychosis | $1B (based on the $25B global Alzheimer’s disease market) | $250M | $15.54 | $10.87 (30% discount because the drug has yet to gain approval) |

| Nuplazid for schizophrenia (negative symptoms) | $500M (based on the $7.9B schizophrenia market) | $125M | $7.77 | $4.66 (40% discount because the drug has yet been approved and clearance to treat negative symptoms is a high hurdle) |

| Trofinetide for Rett syndrome | $500M (small market size but orphan status enabling a premium reimbursement) | $125M | $7.77 | $4.66 (40% discount because the drug has yet been approved) |

| Younger pipeline assets | Will wait for more advancement before valuing | N/A | N/A | N/A |

|

The Sum of The Parts |

$41.18 |

Figure 7: Valuation Analysis

Potential Risks

Since investment research is an imperfect science, there are always risks associated with your stock regardless of its fundamental strengths. More importantly, the risks are “growth-cycle dependent.” At this point in its life cycle, the most immediate concern for Acadia is whether the company can gain Nuplazid approval for ADP by August 4th. As the expert committee voted against approval, the risk that the FDA would follow their recommendation is high.

That aside, there is a 35% chance that trofinetide would not clear the FDA hurdle in 1Q2023. The other concern is if Acadia can continue to ramp up Nuplazid sales for Parkinson’s. With Acadia being a young and aggressive growth company, it can burn excessive cash to potentially cause a cash flow constraint.

Conclusion

In all, I recommend Acadia as a buy with 4.7/5 stars rating. As a successful growth biotech, Acadia achieved greatness in therapeutic innovation. The first fruit of success (Nuplazid) is hitting over halfway toward blockbuster by yearend 2022. With additional upcoming label expansion, you can expect more rapid sales growth. While there is a very good chance that Nuplazid would break the market negative-expectation to gain approval for Alzheimer’s, it also has the other indication (i.e., for schizophrenia). Additionally, Acadia has the upcoming trofinetide approval for Tourette’s. Though I’ve overlooked trofinetide, it’s highly likely to procure substantial revenues to continue powering Acadia topline growth in the coming years.

Going forward, you should keep your eyes on the upcoming Nuplazid FDA decision for Alzheimer’s by August 4th. If approved, the stock is galvanized to increase by two folds. Else, it’ll drop slightly. After all, the market is already expecting non-approval. Regardless of Nuplazid’s outcome, you can expect upcoming sales growth from its existing indication (i.e., Parkinson’s) and the high likelihood of approval of trofinetide in 1Q2023. Next year, the ADVANCE trial will also report data. It would be a very exciting time for Acadia shareholders and patients.

Published at Wed, 03 Aug 2022 03:08:23 -0700