Memo To Meta: Filmed Entertainment Will Save Facebook

Fritz Jorgensen

Meta Platforms (NASDAQ:META) reported second-quarter earnings on Wednesday, July 27. The company missed on both the top/bottom lines. While the sales deviation wasn’t so significant – $130 million on $28.8 billion – it comes with a 0.9% decline compared to the previous year. Not such a big deal statistically, perhaps, but – it’s the first time Meta has experienced a revenue pullback, small as it was. In this environment, it’s going to be something to watch. Also: guidance wasn’t attractive, and GAAP income per share of $2.46 was off by nine pennies.

In this context, I will share some thoughts on how Meta can improve its long-term prospects as social media continues to rapidly evolve.

It’s not like I haven’t written prior about Facebook – now known as Meta Platforms – needing to make movies and television shows; sure, I’ve mentioned it a time or two.

But… times are different now, and Meta – well, it needs to make movies and television shows now more than ever before.

It almost arguably appears as if Meta is inevitably moving in that direction. Considering that the company believes its best bet is an investment in the metaverse/NFT trend, well, one has to ask – what is metaverse/NFT? Isn’t it all just content anyway?

Storytelling, both in feature-film format and episodic, is an asset class that will become more valuable over time. Netflix (NFLX) has offered the proof of concept: people want content; big volumes of it, in fact. There’s even speculation a company such as Microsoft (MSFT) wants to get into the filmed-entertainment business by merging with Netflix, with the speculation being based on the deal to facilitate the streamer’s advertising initiatives.

Think about that: Microsoft partners with Netflix on advertising. Add to that: Amazon (AMZN) buys the Metro-Goldwyn-Mayer library and expands its Prime Video service. Furthermore: Apple (AAPL) continues to patiently build out its lineup of mostly original movies/episodic.

Facebook needs to aggressively claim its own stake in the streaming wars.

Yes, I’ve said it again… and this time, it’s a much different media environment, one that almost demands such participation. The company can’t let the other tech concerns have all the fun – and the cash flow that comes with it – in the original-content industry. And the metaverse, which is currently what CEO Mark Zuckerberg is envisioning as Meta’s best bet (it’s right there in the name change), is, quite frankly, not at all totally resolved; no one knows what its ultimate form will be, and what kind of potential exists within it.

And consider, too, the Reels strategy, as examined in this article. TikTok is changing the online video industry by influencing the length of content. As mentioned, Alphabet’s (GOOG) (GOOGL) YouTube site has responded with shorter-form snippets that aim to monetize brevity. That can lead to a lot of views and the advertising revenue that goes with it. In fact, Reels was highlighted this quarter as generating a $1 billion annual take.

There probably is a bigger opportunity, though, in the movie/episodic business for Meta. Trends come and go, but visual storytelling married with strong intellectual properties will always be in demand.

The interesting thing to me is that Meta has an opportunity to ease into content development very efficiently through its current platforms. If the company is favoring shorter-form content, then short films would be the way to go initially, and that wouldn’t take up too much cash. Facebook, and the data it possesses on its users, represents a built-in marketing machine. Yes, the same could be said for Amazon or any other tech company, but that’s the point – Zuckerberg needs to realize that, before he tackles a new industry that is still in its most nascent of stages, he may want to hedge that with a significant investment in an older-economy business model that is in transition after the Netflix subscriber-decline upheaval.

At this point, it’s worthwhile to mention the cash at the company’s disposal. Meta possessed a little under $13 billion in cash and equivalents at Q2, and almost $28 billion in marketable assets. That’s roughly $40 billion, and that number is against no long-term debt. Roughly $12 billion in cash was generated compared to nearly $8 billion of capital spending. The annual report back in February of this year showed $57 billion for 2021 in cash generation versus capital spending of $18 billion. Back in 2019, that relationship was $36 billion versus $15 billion.

Granted, cash from operations took a slight dip in Q2 (versus $13 billion) and capital spending was significantly higher (a $3 billion increase compared to last year), and it is worth noting that a potential continued inflationary backdrop (which could turn into a recessionary context) obviously will make growth challenging. But the point is not to be missed: Meta does have cash, as well as leverage ability, to make things happen.

Even so, considering my thesis, shareholders might look at that cash landscape and ask about a dividend or an increased buyback (the company took back $5 billion during the quarter). To me, the first thought would be to commence a content strategy, not a payout.

Let’s really think about the long-term aspects of the core Facebook/social-media business. One of the big risks is continued erosion of the model because of issues surrounding data collection. Data will always be collected and used (it would be important with a movie strategy, certainly), but given the well-known issue with Apple’s policy change (as highlighted here) and its effect on the stock, it would appear that pontification of supplemental revenue streams would be of prime importance at this stage in the company’s evolution.

Zuckerberg might not look at filmed entertainment as an appropriate risk in which to invest; he might even look at it as perhaps, for the time being, just not the best bet, especially in comparison to virtual reality/metaverse. Okay, fair enough – maybe metaverse-type stuff is more within the core competency of a social-network expert (or, in Meta’s case, the social-network expert), at least on paper.

But selling/marketing movies has always been a social-type event, and Facebook/Instagram present a pair of platforms that could actually be useful toward the development of content.

Recall that Amazon attempted (and too quickly abandoned) to start a social network of sorts with Amazon Studios. It offered users the ability to submit and develop screenplays in a team-oriented approach, with writing assignments, contests and options (as in, option to develop) part of the mix. The company even offered a set of tools to write/edit scripts, probably with the idea of turning them into a paid suite (that never came to pass).

Facebook could actually finish what Amazon started via a pivot of its social platforms. Plus, targeted acquisitions could help catalyze the initiative.

Users could be asked to submit scripts for consideration, or even post stories/screenplays on the site to see how they compare via different analytics. It could be a similar model to Wattpad, the novel/short-story site that has seen posted content gain traction and popularity on that social network and then convert into published books and filmed-entertainment IP. Wattpad would have made a very interesting acquisition for Facebook, but in the end it turned out that Naver Corporation (OTCPK:NHNCF) bought the business.

But the idea of turning Facebook partly into a content incubator would, to me, give the site a major new point for its mission statement, one that would open up a new ecosystem of synergy. Just as Wattpad essentially creates a fanbase for its subsequent visual storytelling assets, so too would Facebook allow creators to test the waters out for new ideas, with hypothetical new tools of promotion that would be added for just such purpose. If one considers a site such as The Black List for screenplays, it’s easy to see the possibilities – post screenplay, get reviews/comments, reiterate, curate a readership/follower-base, monetize through a Facebook film arm. It’s not so different from Warner Bros. Discovery’s (WBD) DC – in such a case, a built-in audience of potential consumers at theaters came about because of the popularity on the comic-book literary side; those cult fandoms then served as core ticket-buyers that helped take the DC cinematic universe to the mainstream.

And, again, the metaverse and IP such are intertwined. Consider NFT assets – what are they but essentially digital art, with the art that works best being based on branded imagery? If Zuckerberg wants to create his own leading stake in the metaverse, the best way to lead would be via content and IP.

The key question centers on what Facebook really is – remember that line from the film The Social Network, when one of the characters made mention of not knowing exactly what Zuckerberg really had on his hands? Even after all these years, I would argue Facebook hasn’t truly found its identity yet, and of what, precisely, its potential is; yes, it is a cash-generating brand with giant mindshare equity that has become an iconic property that has spanned different formative stages of the Internet.

It’s also tied to a stock that has taken a significant hit based on privacy concerns and other issues. It needs a pivot, and while the metaverse is not something I would argue against as an investing theme, more tangible items that have proven models of return-on-investment – films, series – would be the way I would attack the ongoing relevancy issue of Facebook. Keep in mind, things change fast in tech; the disruptors of today eventually become disrupted themselves. At the very least, Facebook should at least be more aggressively invested in content, making tentpoles that can be released to multiplexes and series that can be streamed on its networks and sold to other streamers or linear ecosystems. It can’t just be Reels – Reels can help the incubation process I spoke of, and it can curate talent, but it can’t just be looked at as just another potential for advertising revenue and another way to keep ahead of TikTok/YouTube. That’s important and, again, a core competency, but Meta should not simply look to others to fill its platform with content – it should be a supplier of content as well a supplier of platforms.

Stock Opinion/Conclusion

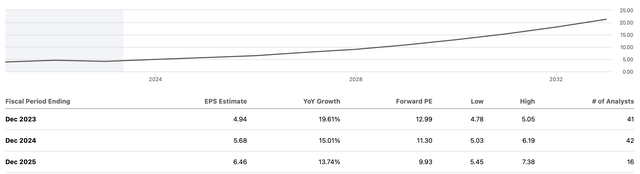

At the time of this writing, the SA valuation system currently assigns basically an average rating for Meta Platforms stock. Many of the metrics aren’t too bad – P/E is under 14 (adjusted, forward) and cheaper than the sector median, for instance – but the forward PEG ratio is expensive compared to the average. That, and the forward P/sales is particularly pricey. Of course, one would presume some sort of premium for buying a brand such as Facebook/Instagram. P/cash-flow, too, is reasonably priced in my opinion.

All of that being said, we’re in a bearish time, and tech stocks are entering a new valuation phase. And woe is the investor who purchased near the top of the 52-week range: $154 versus $348. At the time of this writing, shares were around the $160 area.

Right now, I’m neutral on the stock. In my view, it’s become cheaper than it was, but I don’t feel the need to buy at the moment. There are a lot of bullish articles on SA for Meta Platforms, and those authors’ statistical analyses make great points (here’s an Editors’ Pick article); for me, I’d rather wait some time to see if that 52-week low gets taken out. Even if I decide to buy later and pay a higher price, given market conditions, I’m more risk-averse with this name than to something that is actually in the media business and exists at a cheap valuation (such as Warner Bros. Discovery).

Allocating capital toward movies and episodic, with the aim of selling content to other platforms and engaging theatrical exhibition, as well as setting up some sort of streaming initiative perhaps tied in part to the core social networks (or, as a separate application altogether – certainly both could be accomplished), would allow Meta to not only hedge its core businesses, but also to generate a new source of revenue that will always be in demand. And again, Meta has the tools to bring its user base into a hypothetical content-generating development system, one that uses Facebook/Instagram/Messenger/et cetera, to develop new IP. Meta has the money to hire celebrity talent on a cost-plus basis (i.e., no backend), and it has the data to see what is working in the marketplace of pop culture. Some new, bold, diversifying strategies will be necessary to take the company into the future; Zuckerberg doesn’t want to concentrate solely on short-term cost-containment and headcount issues.

Perhaps it’s inevitable that Mark Zuckerberg eventually experiments with a Hollywood-based model – what is the metaverse if not just another form of show business.

Published at Thu, 28 Jul 2022 01:20:36 -0700